On Wednesday and Thursday, 92.3% of the Ventura Unified Education Association membership voted to accept a tentative contract proposing 10 furlough days and a 4.77% pay cut next school year. Of the 522 votes, 40 were cast against the contract.

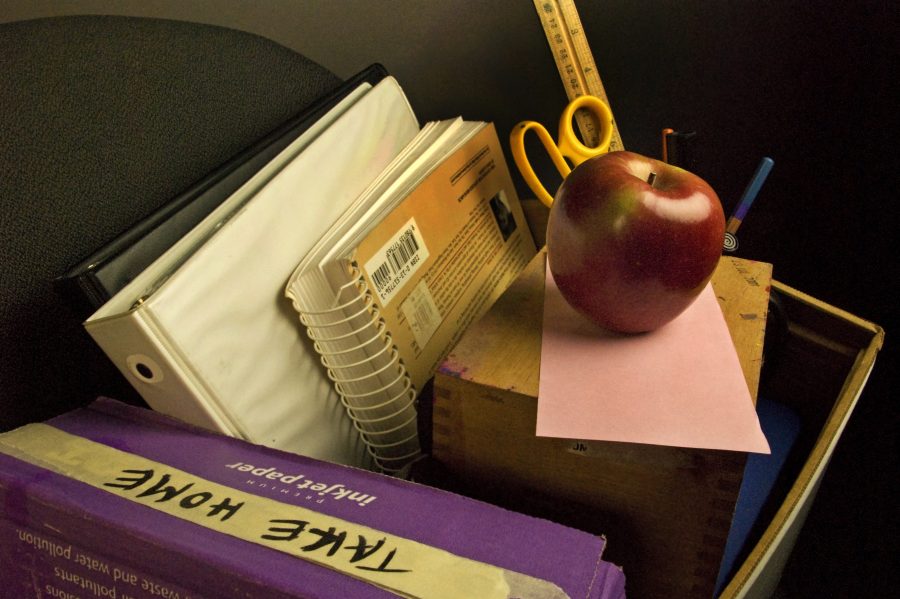

“I’m glad that everyone is being a team and that we are all in it together and looking out for each other. I think the most important thing is looking out for each other and our students, and our fellow coworkers,” said Foothill counselor Debbie Freeman, one of the staff members who received a pink slip. {sidebar id=11}

Though the teachers are officially willing to accept the pay cuts, the jobs of staff members who have received pink slips still may be cut.

“There were about 42 people who were permanent or probationary teachers who got lay off notices; the district is saying that about half of them will be reinstated,” said VUEA president Steve Blum.

“It’s my guess that they will be cautious in not bringing too many back. Eighty-five percent of the district’s budget, roughly, is people. When you’re trying to cut six to seven million out of a hundred and thirty five million dollar budget, people are going to be part of the equation,” Blum said.

Cuts to education will be reduced if a tax extension bill on a special election ballot in June passes with a 51% majority. This bill includes extending and increasing various tax rates, including personal income-taxes, retail-sales taxes, and auto-registration taxes.

“Right now, California is 26 billion in the red. He’s [Governor Jerry Brown] already cut thirteen billion out of the budget and wants the tax extension to continue. That’ll make up the deficit. If [the tax extension bill does not pass], he needs to cut an additional thirteen billion out of the budget, which means there needs to be more cuts to education,” said Foothill counselor and Union representative Steve Boyd.

However, at this point in time, it is unclear whether this bill will even be placed on the ballot. California legislature has not yet voted on this issue.

“The governor has to get the measure through the state legislation. If two-thirds majority vote yes on it, then it goes on the ballot and the people decide. Right now, he doesn’t have two-thirds of the vote in the state senate to do that. Right now, it’s not going to go on the ballot and the people will not decide,” explained Boyd.

Due to Republican legislators’ unwillingness to pass the tax extension bill, Blum does not expect that it will make it onto the June ballot.

“My sources in Sacramento say there’s maybe a ten, fifteen, twenty percent chance that it will get on the ballot. They aren’t real optimistic. There’s still a chance. I think it has a better chance of passing if it goes up to the people,” he said.

It also remains unclear whether or not the voters will back the tax extension bill if it does make it onto June’s special election ballot. A recent survey from the Public Policy Institute of California reveals that only 46% of voters show support for the bill. Only two months ago in another survey, a majority of 53% approved.

“It’s always hard to know what the electoral will do, especially on a special election,” said Blum. “The economic picture doesn’t look rosy.”