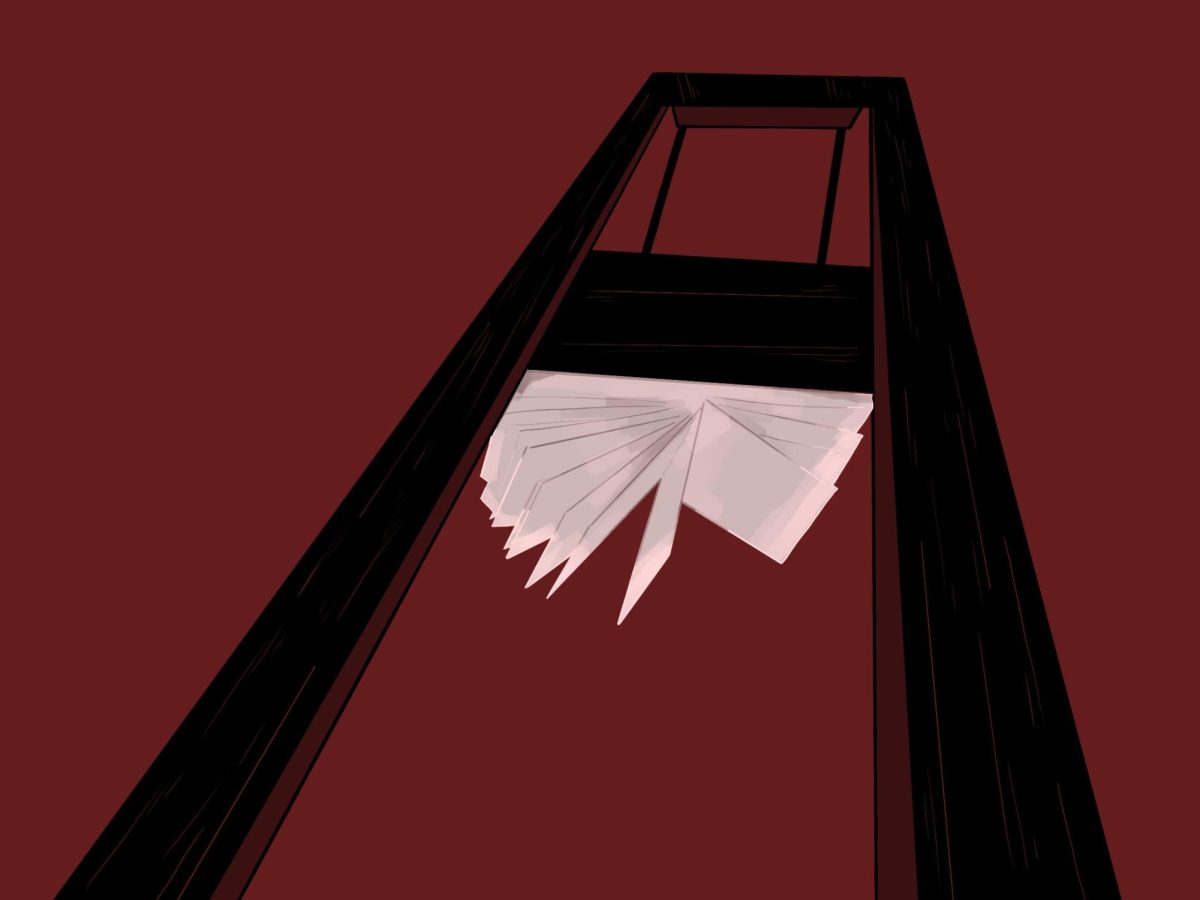

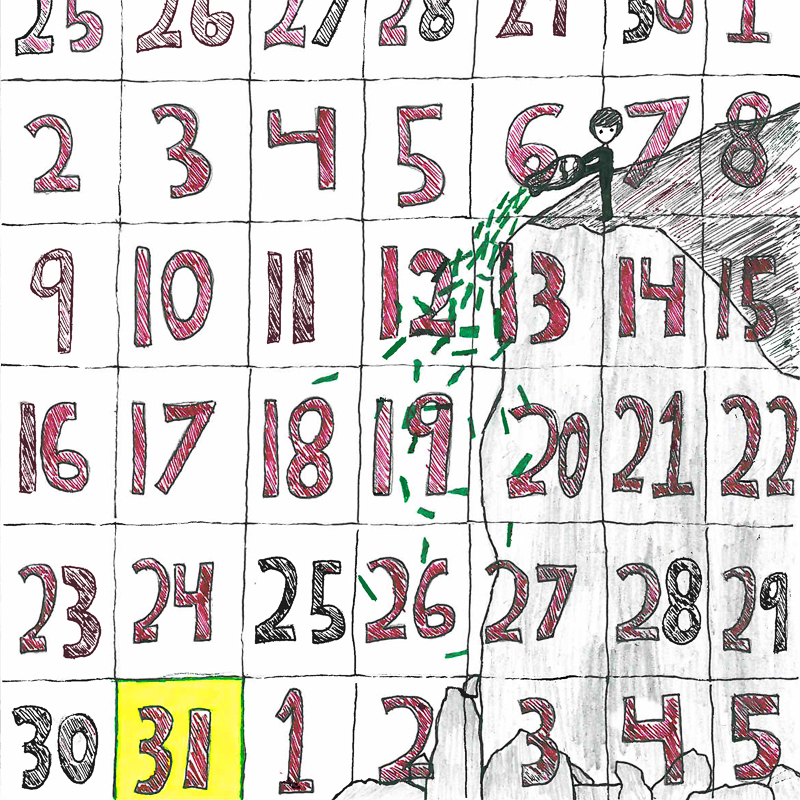

As 2013 approaches, the looming menace that is the “fiscal cliff” grows larger and larger, jeopardizing the financial safety of all Americans. If there has ever been a time where mountains, metaphorical or physical, needed to be moved, it’s right now.

The “fiscal cliff” is the nickname given to the economic outcome of several laws that, if left unchanged, will result in a massive tax increase for all Americans. This “fiscal cliff” can only be absolved if enough money is generated by the end of 2012 to greatly reduce the deficit.

Several plans have been offered to solve our country’s dire economic crisis, but the one in particular that appears to be the most evenhanded is a combination of cutting government spending and raising taxes for the wealthiest percentage of this nation. This would generate enough revenue to reduce the deficit and almost completely eradicate the ominous “fiscal cliff.”

President Obama called for the House of Representatives to pass a bill that would increase tax rates for the rich, while keeping the tax rates for the middle class the same. He addressed the nation and briefly summarized the ultimate goal he had for this plan of action, which was, in the short, run ebbing the nation away from the “fiscal cliff” and in the long run eliminating the deficit all together.

This was the same strategy used by former President Bill Clinton back in the 1990s. Not only did it get the country back into a stable financial position after the large deficit left by former president George H.W. Bush’s poor economic policies, but it also gave the country a massive surplus. So, as far as financial plans go, this one is very solid and reliable.

However, the problem most people have with this approach isn’t its success rate. It’s the tax increase.

For as long as they have existed, taxes have been a nuisance to all who have ever had to pay them, but they are a necessary part of a thriving economy. Though people understand the necessity of taxes, they still try and find ways to avoid them. Not choosing Obama’s reasonable tactic, which just so happens to involve taxing, would be the current plan of action in people’s “war against taxation.”

Now I agree that tax increases for all would be completely out of the question. With the recession currently financially incapacitating most middle class citizens, it would be irrational to increase the tax rate for all Americans. Doing that would only inhibit the middle class from growing and possibly send thousands of borderline lower middle class members into financial turmoil.

Then again, Obama’s plan takes this into consideration. Actually, Obama’s plan doesn’t tax the middle class at all. It focuses directly on taxing the wealthiest percentage of Americans, which is exactly why so many Congressmen and people of power have a problem with it. It doesn’t affect a large percentage of Americans, but it does directly affect them.

Another argument that this perfectly legitimate plan is bombarded with is that wealthy people should not be “penalized” for supposedly working harder than the rest of the country.

First of all, the fact that anyone would have the arrogance to say that they work “harder” than an entire class of people based solely on their income is just ignorant. The difficulty of your profession is not based on your salary, it is based on the amount of time and effort you put into it. Being a CEO may require more college degrees than a grocer, but that doesn’t mean you are better than someone nor does it give you the right to look down on other people.

Secondly, taxes are not a penalty. They benefit everyone, including the person paying them. They help maintain the roads we drive on, keep kids in school, provide healthcare to the less fortunate. Isn’t the well being of your country more important than the condition of your personal golf course?

The key to achieving a stable economy and eliminating the threat of the “fiscal cliff” is shared sacrifice.

In the words of billionaire Warren Buffet, “My friends and I have been coddled long enough by a billionaire-friendly Congress. It’s time for our government to get serious about shared sacrifice.”