California’s budget is headed for dire straits.

Facing a $25.4 billion shortfall this year, Governor Jerry Brown has delineated $12.5 billion in cuts to be matched by a nearly equal amount of new tax money, the San Francisco Chronicle reported.

This isn’t the first time we have ever faced a deficit, to be fair, but this unprecedented shortfall is coming in a time when the American economy is sluggish and jobs seem to be melting into the ether. That only serves to exacerbate the economic crisis California has found itself in.

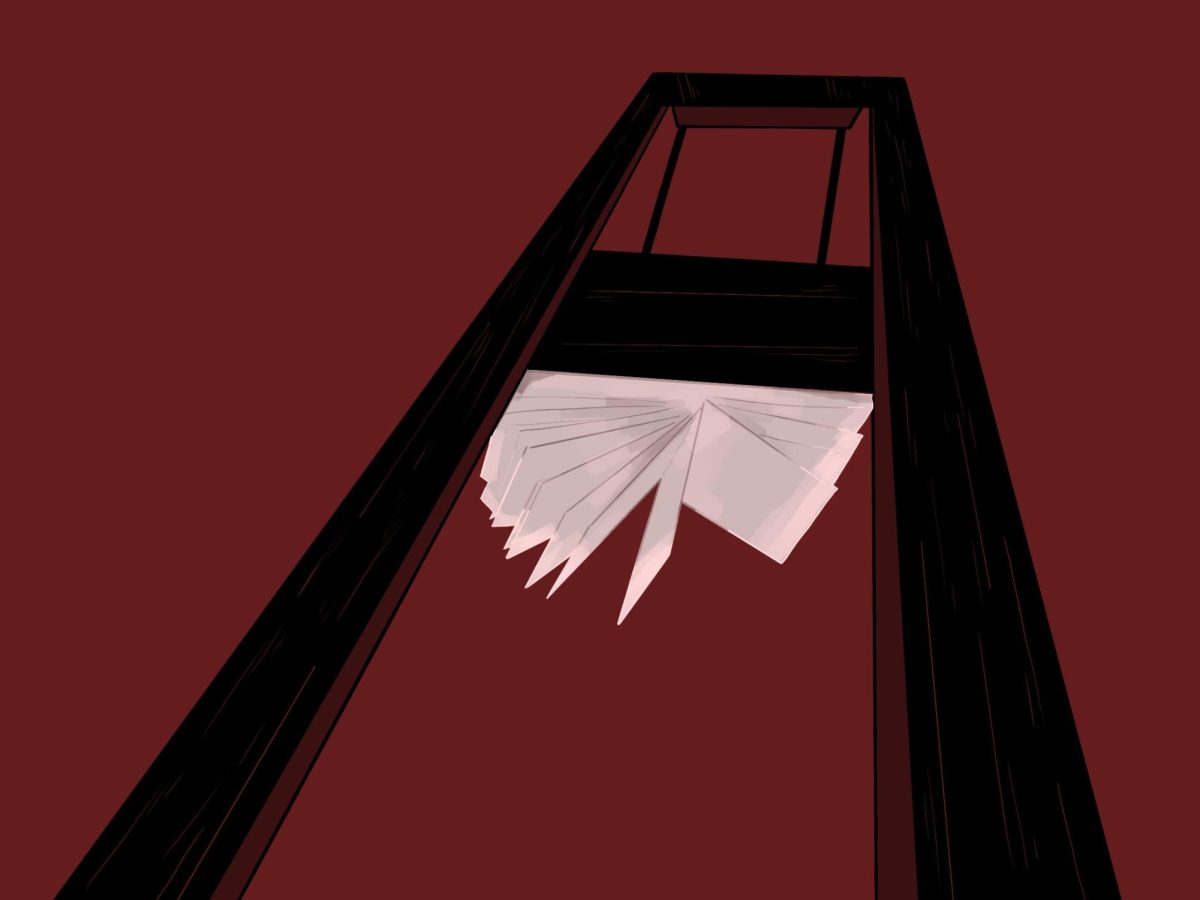

If Brown has his way, Californians will vote on a parachute that might soften the free fall, a tax revenue measure in a June special election, which could provide some security for school budgets. And this security is important.

With budgets that are already stretched, however, some school districts are preparing separate plans for best and worst case scenarios.

The budgets set up under the best-case scenario, where these tax measures are passed, keep our schools afloat at about the same budget level. The worst case scenario budgets mean layoffs, more furlough days, and even more limited funds for materials.

Foothill has already felt some of the budget crunch this year. Though the school avoided the worst–it is perhaps too small and too high performing to receive the sweeping pink slips felt by high schools in the Los Angeles Unified School District–this year we have been introduced to two furlough days.

Furlough days benefit no one: teachers don’t get paid and students aren’t being taught, they mean that the school simply can’t afford to be open on that day. If these taxes don’t pass, it seems that we’ll be headed for limited school years in the style of the Great Depression.

Schools, courts, small businesses, fire departments may take hits

Many people on both sides of the spectrum are understandably concerned about all of these tax increases and cuts. Republicans shy away from new taxes, fearing that they will impede economic dynamism. Democrats are leery of budget cuts to social services they champion, fearing that it will leave people who need the service with no options.

And many more complain that the revenue raised by taxes will be wasted in the Californian bureaucracy, which has become notorious for its robust state pensions and the Bell scandal.

Yes, there is corruption in government. There is inefficiency and waste, because there is always inefficiency and waste in a bureaucratic system. But take note of two things.

First, we know about those scandals; intrepid journalists at the Los Angeles Times uncovered the Bell City scandal, and precluding journalism’s total collapse under the pressure of new media and dwindling budgets, there will always be intrepid watchdog journalists looking to uncover fraud and warn the people. We can’t necessarily convince people to stop their attempts to bilk the system, but we can catch them at it and put a stop to it.

Second, without these taxes education budgets specifically will suffer, which the Sacramento Bee reported on Monday. Experts predict the elimination of class-size reduction, the requirement that kindergarten students be 5 years old at enrollment and a hike in UC and CSU tuition by another 7 to 10 percent, according to a review by the nonpartisan Legislative Analyst’s Office.”

Other suggestions have been made to cover the budget gap if these ballot measures fail, and none of them are pretty. Reducing pay to state workers by an additional 9.24 percent (which would equal two more furlough days) and reducing state contributions to employee healthcare by 30 percent was one option proposed by State Senator Mark Leno.

Regardless of their stance on new taxes, most Americans would agree that teachers are not overpaid. This plan would still add additional furlough days, and California’s students will be the ones picking up the tab on their short-changed education.

Other areas face deep cuts as well, especially our courts and health and human services, and even small business loans are projected to take a hit. As for wildfire protection, without funds to support the program, your best bet may be a bucket of water if you’re in a wildfire zone.

But the fact remains that when the state needs to balance its budget, education will be one of the first institutions on the cutting room floor.

“New taxes” are not really new

Some are in favor of the measure that might be placed on the state’s June ballot, which would extend tax hikes that were first passed in 2009.

“Many of these aren’t even new taxes,” said Foothill teacher Cherie Eulau. “They’re just extensions of taxes we already have.”

This is true; Brown’s “new taxes” are really extensions of tax hikes, such as one that would renew a quarter-percentage point increase in personal income tax rates, which expired at the end of 2010.

The problem is that it seems deeply ingrained in the American character to run in the other direction when taxes are mentioned, dating right back to the Revolutionary War.

Measure H already failed to pass in the city of Ventura in November, despite the warnings of a $5 million budget shortfall for Ventura Unified in 2012-2013. This will mean serious cuts in our district, no matter what happens with the state budget.

No one likes taxes. Those who support raising taxes do not do so because they think paying taxes is a fun way to spend the day; the fact of the matter is, the state needs revenue to cover its budget shortfalls.

Yes, some cuts will likely be made as well, and tightening our belts in an economic downturn is inevitable. California will have cuts no matter what, as the state has opted for a fairly moderate approach to our serious budget problem. We’re probably not going to fix all of the potholes on the Ventura Freeway.

But by ensuring that we have revenue, we will be able to keep our education system functioning at least as well as it currently does. Students don’t deserve to be kicked out of their classrooms because the state can’t balance its budget.

Cuts alone could close the budget gap, but not without significant harm to programs our state needs.

Our state already has one of the lowest per student spending rates in the nation, and our school districts are well below the national average for budgets. Our local school district is already facing uncertainty and budget shortfalls, adding on a state budget crisis will exacerbate Ventura’s problem.

Take a look at Florida, a state that is also facing budget shortfalls, but plans to take a very different approach to addressing them.

Newly elected conservative governor Rick Perry recently unveiled his budget plan for the state. “His declared intention to cut regulations and taxes, and a ‘slash-and-burn’ approach to putting Florida’s financial house in order with little apparent regard for real-world implications, have prompted warnings of dire consequences.”

A call for state lawmakers to place measure on the June ballot

Of course, the people of California won’t even have a chance to vote on these measures if two-thirds of the state legislature doesn’t vote to put them on the ballot. We can only hope they do, because even if the people of California choose to let these taxes expire, they should at least have the chance to vote on it.

Some 53 percent of respondents to a Public Policy Institute of California poll released last week said they would support the tax extension, which will be enough to pass the measure in June. Despite our cultural aversion, many Californians seem willing to bite the bullet and face up to our deficit.

Balancing this high-deficit budget is no easy feat. Try the Next 10 Budget Challenge if you’re not convinced, and see what you come up with to make ends meet.

None of our options are good in the traditional sense; it’s just an avoidance-avoidance scenario. When presented with two undesirable options, we need to weigh our alternatives and choose the one that causes the least overall harm to the state.

We can only hope that our schools won’t fall by the wayside as purse strings are tightened.

{jcomments on}